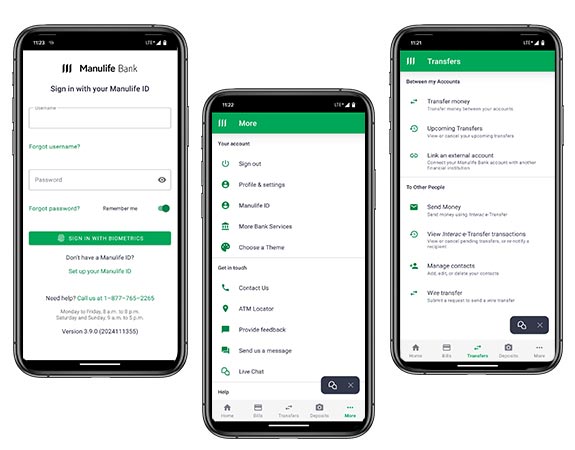

Do more on the go

Take care of daily banking

- Check your balances and transaction history

- Send money using Interac e-Transfer®

- Deposit cheques

- Make or schedule bill payments and money transfers

- Review upcoming payments and transfers

- Find an ATM

Shop with your mobile wallet

- Use Apple Pay®, Google Pay™ and Samsung Pay™ to shop securely with your Manulife Bank debit card

- Use Apple Pay®, Google Pay™, Samsung Pay™, and Garmin Pay™ to shop securely with your ManulifeMONEY+™ Visa* card

- Make purchases with your smartphone, smart watch, or tablet any place you can tap your card

- Track your spending and organize receipts digitally

Download the mobile banking app

- Snap a picture to deposit a cheque.

- Request a mortgage increase from a café.

- Find the nearest ATM, wherever you are.

- With the Manulife Bank mobile app, your bank is in your pocket.

- Scan the QR code with your mobile device and download the app!

Need help? Visit mobile tech support

Want to know more?

Have a look at some of the frequently asked questions below, or get in touch and contact us

Deposit a cheque anywhere, anytime by taking a photo.

- Tap Deposit in the bottom navigation bar

- Select the to account

- Type the dollar amount on the cheque

- Tap Front of cheque, centre the front of the cheque and let the app take the picture

- Tap Back of cheque, centre the back of the cheque and let the app take the picture

- Tap Next

- Tap Confirm

- Your Apple smartphone or tablet must be running iOS 9.0 or higher

- Your Android smartphone or tablet must be running version 4.2 or higher

- Your device must have a camera

- Photograph the cheque on a dark background with all four corners visible in the frame and without shadows, folds or bent corners

- Make mobile deposits to your Canadian-dollar Advantage Account, Business Advantage Account, Line of Credit, Manulife One, or Manulife Bank Select chequing account

- Deposit personal, business, government, convenience and counter cheques, as well as money orders – each with a maximum value of $1,000,000

- Cheques must be payable to you, issued in Canadian currency, and drawn on a Canadian financial institution

- You cannot deposit cheques dated more than six months ago or post-dated

- Access up to $100 of your deposit right away, and the rest after five business days

- See the transaction in your account history the next business day

- Keep your cheque for 15 days after the deposit date and then destroy it

- For your security, cheque images are never stored on your mobile device

Pay a bill right away or set up a future payment.

- Tap Bills in the bottom navigation bar

- Tap Pay a bill

- Select the payee or add a new payee

- Select From which account?

- Type the dollar amount you want to pay

- Select the frequency (once, weekly, bi-weekly, monthly, end of every month or annually)

- Select the date you want to pay the bill

- Tap Next

- Tap Confirm

- Your payee will generally receive your payment in three to five business days – the same amount of time as online banking

- To delete a payee, tap Bills and then Manage payees. You will see your list of payees. By swiping left, you will be given the option to delete the payee.

- To stop a bill payment, tap Bills and then Upcoming payments; tap the bill payment that needs to be stopped. Tap Stop payment.

To transfer money between your Manulife Bank account and your account at another Canadian bank, you need to link your accounts:

- Tap Transfers in the bottom menu.

- Tap Link external account.

- Tap Get Started and follow the steps to log in and authenticate with your financial institution using Flinks.

- Once connected, select the account you would like to link.

- Review the agreement and click Link Account.

- Your account is now linked. Visit Transfer money to make a money transfer.

Once the external bank account has been linked, it’s simple to set up individual or recurring transfers:

- Sign into the Manulife Bank mobile app.

- Tap Transfers in the bottom menu.

- Tap Transfer money.

- Follow the on-screen steps to move money between your accounts.

Note: If you want to transfer money into or out of your external bank account, the transfer must be scheduled at least one business day in the future.

- To view recurring money transfers, tap Transfers, then Upcoming transfers

- To cancel a future money transfer, tap Upcoming transfers; tap the transfer that needs to be stopped, then tap Delete transfer

Check your balance and see your transactions.

- Tap Accounts in the bottom navigation bar to see your deposit and loan account balances

- Tap an account name to see details including your current interest rate, deposits, and withdrawals

- Tap the drop down at the top to switch between accounts

- The app automatically displays transactions in last 30 days

- To choose a different date range, tap the filter icon

- Select the current month, previous month, or input your own date range

As a Manulife Bank customer, you have fee-free access to thousands of ATMs across Canada that are part of THE EXCHANGE® Network. Use our ATM locator to find the one that's closest to you. You'll be able to see within the ATM locator which of these machines accept deposits and which are withdrawal-only.

Note that ATM transaction fees may still apply for specific products or transactions.

In addition to ATMs bearing THE EXCHANGE Network logo, you can also make withdrawals at any ATM bearing the Interac® logo. However, you may be charged additional fees for ATMs that don't have THE EXCHANGE Network logo.

You can also get money with in-store cash back from participating retailers.

Yep! Whether you're banking online or through the mobile app, use the same login credentials to access your account.

A mobile wallet is an app on your mobile device that allows you to add payment information from your credit or debit card and make purchases with your device. You may also be able to keep loyalty club memberships and reward cards in your mobile wallet.

There are several different mobile wallet apps available, but the main five are Apple Pay®, Google Pay™, Samsung Pay, and Garmin Pay™. You can add your ManulifeMONEY+™ Visa* card to all five mobile wallets and your Manulife Bank debit card to Apple Pay®, Google Pay™ and Samsung Pay. Cards loaded into a mobile wallet can be used to make secure and convenient purchases in stores, other apps, and online shops that accept mobile payments.

®Trademark of Interac Corp. Used under licence.

*Trademark of Visa Int., used under license.

Apple, Face ID, Touch ID, and Apple Pay are trademarks of Apple Inc.

Android and Google Pay are trademarks of Google Inc.

Samsung Pay is a registered trademark of Samsung Electronics Co., Ltd.

Garmin Pay is a registered trademark of Garmin Ltd.

Manulife, Manulife Bank & Stylized M Design, and Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.